- List Of Slot Branches In Lagos Florida

- List Of Slot Branches In Lagos Sri Lanka

- List Of Slot Branches In Lagos Maryland

- List Of Slot Branches In Lagos Africa

| Public | |

| Industry | Finance |

|---|---|

| Founded | 1894 (as Bank of British West Africa) 1979 (renamed First Bank of Nigeria) |

| Headquarters | 35 Marina, Lagos, Lagos State, Nigeria |

Number of locations | Over 700 business outlets (2020) |

Mrs. Ibukun Awosika Chairman Urum Kalu Eke Mfr Group Managing Director, FBN Holdings Dr. Adesola Adeduntan Group Managing Director/CEO Gbenga Francis Shobo, ACA Deputy Managing Director Abdullahi Ibrahim] Executive Director, Public Sector Remi Oni Executive Director, Corporate Banking | |

| Products | Financial Services |

| Revenue | Pretax: N70,800,000,000 |

| N294,400,000,000 | |

| N62,700,000,000 | |

| Total assets | N5,900,000,000,000 |

Number of employees | 16,000 |

| Website | firstbanknigeria.com |

Mondays to Fridays: 9am – 3pm and Saturdays: 10am – 2pm. During this time all Lagos stores, Abuja stores, Yola connect store, Mubi connect store, Owerri connect store, Port Harcourt Int’L Airport connect store, Ilesa connect store, Ilorin connect store, Ilorin East connect store, Kwara mall connect store, Offa connect store, Oshogbo connect store will remain temporarily closed. Www.slot.ng; Q3: Physical Address,Branches And Locations Of Slot Mobile In Nigeria? A: HEAD OFFICE NO 2B, MEDICAL ROAD IKEJA LAGOS 3, 0 COMPUTER VILLAGE BRANCH 15/19 OLA-AYENI STREET. IKEJA LAGOS 3, 0 OPEBI BRANCH NO 19 OPEBI ROAD, AWOSIKA B/STOP IKEJA 0 IKEJA CITY MALL ALAUSA IKEJA 4.

First Bank of Nigeria Limited (FirstBank), is a Nigerianmultinationalbank and financial services company headquartered in LagosNigeria.[1] It is the premier bank in West Africa with its impact woven into the fabric of society. First Bank of Nigeria Limited operates as a parent company in Nigeria, with the subsidiaries FBNBank in the Republic of Congo, Ghana, The Gambia, Guinea, Sierra-Leone and Senegal; FBN Bank UK Limited in the United Kingdom with a branch in Paris; FirstBank Representative Office in Beijing to capture trade-related business between geographies. FirstBank also operates First Pension Custodian Nigeria Limited, Nigeria’s foremost pensions custodian. The teeming customers of the FirstBank Group are serviced from a network of over 700 business locations across Africa. To promote financial inclusion and reach the unbanked and underbanked, FirstBank has an extensive Agent Banking network, with over 53,000 agent locations across Nigeria. The Bank specialises in retail banking and has the largest client base in West Africa, with over 18 million customers. For eight consecutive years (2011 - 2018) FirstBank received the Best Retail Bank in Nigeria award by The Asian Banker.

FirstBank has a The FirstBank Group employs over 16,000 staff and is proudly a multiple Best Place to Work awardee. It operates along four key Strategic Business Units (SBUs) – Retail Banking, Corporate Banking, Commercial Banking and Public Sector Banking. It was previously structured as an operating holding company before the implementation of a non-operating Holding Company structure (FBN Holdings) in 2011/2012

Overview[edit]

As of December 2019, the Bank had assets totalling NGN5.9 trillion.[2].The Bank's profit before tax for the twelve months ending 31 December 2019 was approximately NGN70.8billion. FirstBank’s ownership is diversified, with over 1.3 million shareholders. The bank was founded in 1894 and is Nigeria’s oldest bank. It converted to a public company in 1970 and was listed on The Nigerian Stock Exchange (NSE) in 1971. However, as part of the implementation of the non-operating holding company structure, it was delisted from the NSE and replaced with FBN Holdings Plc. in 2012.

FirstBank has been named ' Best Bank Brand in Nigeria' for six years in a row – 2011 to 2016 – by The Banker magazine of the Financial Times Group; it was awarded 'Most Innovative Bank in Africa' in the EMEA Finance African Banking Awards 2014; it has clinched the “Best Bank in Nigeria” award by Global Finance Magazine 15 times and the “Best Private Bank in Nigeria” by World Finance Magazine seven times.Some other recent awards received by the Bank are “Best Banking Brand Nigeria, 2019” by Global Brands Magazine; “Best Mobile Banking App – Nigeria, 2019” by Global Business Outlook and “Best Financial Inclusion Program – Nigeria, 2019 by International Investor.

Subsidiaries[edit]

The subsidiaries of First Bank of Nigeria include the following:[3]

- FBN Bank (DRC) Formerly Banque International de Credit (BIC) – Kinshasa, Democratic Republic of the Congo – (75% shareholding) is a subsidiary of First Bank of Nigeria Limited, and was until September 2014 called BIC which was founded in April 1994[4]

- FBN Bank (China) – Beijing, China – representative office

- FBN Bank (Ghana) – Accra, Ghana – 100% shareholding[5]

- FBN Bank (Guinea) – Conakry, Guinea – 100% shareholding

- FBN Bank (Senegal) – Dakar – 100% shareholding

- FBN Bank (Sierra Leone) – Freetown, Sierra Leone – 100% shareholding

- FBN Bank (South Africa) – Johannesburg, South Africa – representative office

- FBN Bank (UAE) – Abu Dhabi, United Arab Emirates – representative office

- FBN Bank (UK) – London, United Kingdom – 100% shareholding – savings products sold under FirstSave brand

- FBN Bank (UK/Paris) – Paris, France – a branch of the subsidiary in the UK

- First Pension Custodian Limited

- FBN Mortgages Limited

- FBN Bank (Gambia)

FBN Holdings[edit]

In 2010, the Central Bank of Nigeria revised the regulation covering the scope of banking activities for Nigerian banks. The universal banking model was discontinued and banks were required to divest from non-core banking businesses or adopt a holding company structure. FirstBank opted to form a holding company, FBN Holdings Plc., to capture synergies across its already established banking and non-banking businesses. The new structure resulted in a stronger platform to support the Group’s future growth ambitions domestically and internationally.

Bello Maccido, who was Executive Director (Retail, North) of FirstBank, became the CEO of the new parent company. He retired effective from 31 December 2015 and was succeeded by Urum Kalu Eke Mfr (former Executive Director, South of FirstBank) as Group Managing Director of the Holding Company. The shares of FBNHoldings are listed on The Nigerian Stock Exchange. The business groups of FBNHoldings are:

- Commercial Banking – includes First Bank of Nigeria Ltd and all its commercial banking subsidiaries: FBNBank (UK) Ltd with a branch in Paris, France, FBNBank DRC, FBNBank Ghana, FBNBank Gambia, FBNBank Guinea, FBNBank Sierra-Leone, FBNBank Senegal, First Pension Custodian Limited, FBN Mortgages Limited.

- FBNQuest – FBNQuest is the brand name of the Merchant Banking and Asset Management businesses of FBN Holdings Plc, which comprises FBNQuest Merchant Bank Limited, FBNQuest Capital Limited, FBNQuest Securities Limited, FBNQuest Capital Asset Management Limited, FBNQuest Trustees Limited, FBNQuest Funds Limited and FBN Capital Partners Limited.[6][7]

- Insurance – Insurance-related subsidiaries: FBNInsurance, FBN General Insurance and FBN Insurance Brokers. The business group offers life and general insurance services as well as insurance brokerage services.

As at 31 December 2015, the Group closed with gross earnings of N505.2 billion, total assets of N4.2 trillion and N578.8 billion in total equity.

History[edit]

Pre-independence[edit]

FirstBank commenced business in 1894 in what was then the British colony of Nigeria, as the Bank of British West Africa.[8] The bank originally served British shipping and trading agencies in Nigeria. The founder, Alfred Lewis Jones, was a shipping magnate who originally had a monopoly on importing silver currency into West Africa through his Elder Dempster shipping company. According to its founder, without a bank economies were reduced to using barter and a wide variety of mediums of exchange, leading to unsound practices. A bank could provide a secure home for deposits and also a uniform medium of exchange. The bank primarily financed foreign trade, but did little lending to indigenous Nigerians, who had little to offer as collateral for loans.

Post-independence[edit]

After Nigeria's independence in 1960, the Bank began to extend more credit to indigenous Nigerians. At the same time, citizens began to trust British banks since there was an 'independent' financial control mechanism and more citizens began to patronise the new Bank of West Africa.

In 1965, Standard Bank acquired the Bank of West Africa and changed its acquisition's name to Standard Bank of West Africa. In 1969, Standard Bank of West Africa incorporated its Nigerian operations under the name Standard Bank of Nigeria. In 1971, Standard Bank of Nigeria listed its shares on the Nigerian Stock Exchange and placed 13% of its share capital with Nigerian investors. After the end of the Nigerian civil war, Nigeria's military government sought to increase local control of the retail-banking sector. In response, now Standard Chartered Bank reduced its stake in Standard Bank Nigeria to 38%. Once it had lost majority control, Standard Chartered wished to signal that it was no longer responsible for the bank and the bank changed its name to First Bank of Nigeria Limited in 1979. By then, the bank had re-organized and had more Nigerian directors than ever.

In 1991 the Bank changed its name to First Bank of Nigeria Plc following listing on The Nigerian Stock Exchange. In 2012, the Bank changed its name again to First Bank of Nigeria Limited as part of a restructuring resulting in FBN Holdings Plc ('FBNHoldings'), having detached its commercial business from other businesses in the FirstBank Group, in line with the requirements of the Central Bank of Nigeria. FirstBank had 1.3 million shareholders globally, was quoted on The Nigerian Stock Exchange (NSE), where it was one of the most capitalised companies and also had an unlisted Global Depository Receipt (GDR) programme, all of which were transferred to its Holding Company, FBN Holdings in December 2012.

In 1982 FirstBank opened a branch in London, which it converted into a subsidiary, FBN Bank (UK), in 2002. Its most recent international expansion was the opening in 2004 of a representative office in Johannesburg, South Africa. In 2005 it acquired FBN (Merchant Bankers) Ltd. Paribas and MBC International Bank Ltd, a group of Nigerian investors, had founded MBC in 1982 as a merchant bank, and it became a commercial bank in 2002.

In June 2009, Stephen Olabisi Onasanya was appointed Group Managing Director/Chief Executive Officer, replacing Sanusi Lamido Sanusi, who had been appointed Governor of the Central Bank of Nigeria. Onasanya was formerly Executive Director of Banking Operations & Services. He retired on 31 December 2015 and Adesola Adeduntan took over as Managing Director/Chief Executive Officer, First Bank of Nigeria Ltd and Subsidiaries effective 1 January 2016, with Gbenga Shobo as Deputy Managing Director.

Key milestones[edit]

- 1894 – Incorporated and headquartered in Marina, Lagos, Nigeria, West Africa's commercial nerve centre.

- 1912 – Calabar branch, the second branch in Nigeria, was opened by King Jaja of Opobo; Zaria branch was also opened as the first branch in northern Nigeria.

- 1947 – FirstBank advanced the first long-term loan to the then colonial government, followed in 1955 by a partnership with the government to expand the railway lines.

- 1971 – First listing on the Nigerian Stock Exchange (NSE).

- 1991 – First Automated Teller Machine (ATM) introduced at 35 Marina as part of convenient, online real time banking.

- 1994 – Launched first university endowment programme in Nigeria.

- 2002 – Established FBN UK regulated by the FSA, the first Nigerian Bank to wholly own a full-fledged bank in the UK.

- 2004 – Launched a new brand identity which introduced substantial changes in the look and feel of the FirstBank brand.

- 2007 – Introduced Finnone credit administration software as the first bank in Africa to pioneer the service.

- 2011 – Launched the first biometric ATM and cash deposit ATM in Nigeria.

- 2012 – Became a subsidiary group of FBN Holdings Plc.

- 2013 – Completed the acquisition of ICB asset in Guinea, Gambia, Sierra Leone and Ghana as part of an ongoing Pan African expansion program.

- 2014 – Initiated, at 120 years, the launch of a new corporate identity.

Leadership[edit]

List Of Slot Branches In Lagos Florida

- Chairman – Ibukun Awosika[9]

- Managing Director/CEO – Adesola Adeduntan[10]

- Deputy Managing Director – Olugbenga Francis Shobo[11]

- Executive Director/Public Sector Group – Abdullahi Ibrahim[12]

- Executive Director, Corporate Banking – Remi Oni[13]

See also[edit]

References[edit]

- ^'First Bank Of Nigeria'. today.ng. May 19, 2017.

- ^'XE: Convert USD/NGN. United States Dollar to Nigeria Naira'. www.xe.com. Retrieved 2017-08-29.

- ^Subsidiaries of First Bank of Nigeria[permanent dead link]

- ^Chima, Obinna (2011-10-14). 'Nigeria: First Bank Expands, Acquires Congolese Bank'. This Day (Lagos). Retrieved 2017-08-29.

- ^Acquisition of ICB Takes First Bank to Four Countries FBN Bank Acquires ICB Assets In Four West African Countries

- ^'FBN Holdings launches FBNQUEST'. The Eagle Online. Retrieved 2018-10-28.

- ^'FBNHoldings renames its merchant banking and asset management businesses - Businessamlive'. Businessamlive. 2017-12-19. Retrieved 2018-10-28.

- ^'Our History'. firstbanknigeria.com. Retrieved June 8, 2017.

- ^'Ibukun Awosika becomes the first female chairperson of First Bank of Nigeria - Ventures Africa'. Ventures Africa. 2015-09-08. Retrieved 2018-10-28.

- ^'FirstBank CEO, Adeduntan joins global influencers and experts at the 2018 Financial Times Nigeria Summit and Cambridge Business in Africa Conference'. Nairametrics. 2018-05-31. Retrieved 2018-10-28.

- ^'Francis Olugbenga Shobo, Deputy Managing Director, First Bank Nigeria Limited PageOne.ng'. PageOne.ng. 2016-10-26. Retrieved 2018-10-28.

- ^'FirstBank appoints Abdullahi Ibrahim as Executive Director'. FirstBank appoints Abdullahi Ibrahim as Executive Director. Retrieved 2018-10-28.

- ^'Oni joins FirstBank Board, Odubola retires - Vanguard News'. Vanguard News. 2016-04-17. Retrieved 2018-10-28.

External links[edit]

Smartphone prices are constantly on the rise, and it is also increasingly becoming difficult to shell out huge amount of money (in one go) on a gadget, particularly in a country like Nigeria where there is no solid financing structure.

In developed countries, network carriers, smartphone manufacturers and vendors offer instalment pricing options and financing plans that allow users purchase new smartphones and spread payment monthly across a specified period.

In Nigeria, however, this smartphone financing plans aren’t as widespread as it is in developed countries but there are certain e-commerce platforms and gadgets retailers that offer flexible payment plans on smartphones, laptops, accessories, electronics and other selected gadgets.

We’ll take a look at some of these platforms, details of their financing plans, supported devices, and the requirements.

List Of Slot Branches In Lagos Sri Lanka

1. Easybuy

Easybuy is a mobile device financing platform operated by Palmcredit. Easybuy offers flexible financing plans for people looking to purchase smartphones but cannot pay the one-off cost of their desired device.

All you need to do is pay an initial deposit (at least 30% of the phone’s cost) and work out a financing plan with Easybuy that lets you spread the payment of the remaining 70% (plus interest) over 3 — 6 months. The process is pretty easy and we have written a detailed A – Z guide on how to buy a smartphone (and other devices) on loan using Easybuy. Check out the guide below.

List Of Slot Branches In Lagos Maryland

Continue Reading:How to Buy Smartphone & Other Devices With Easybuy Loan App

2. Jumia Nigeria

Jumia Nigeria runs a flexible financing structure for its customers who cannot afford to pay a one-off price on devices of their desired devices. The plan is under a subsidiary of Jumia Nigeria known as “Jumia Flex”. Customers of Jumia Nigeria can purchase selected smartphones, laptops, and other devices and spread payments across 3 — 6 months.

To do this, simply visit the Jumia Flex website and select the device you want to purchase, fill the application form and submit. Jumia Flex typically processes applications within 3 working days of submission. If you possess the required documents and everything on your application checks out, your application would be approved and you would be invited to pick your phone at the company’s office.

The entire application process is online and the requirements are listed below.

Requirements

List Of Slot Branches In Lagos Africa

- Bank Verification Number

- Bank Statement from last 6 months (in PDF)

- A valid ID card (National ID card, International passport, Voters Card, or Driver’s license)

Device purchased under Jumia Flex financing plans are in good conditions and protected under a 12-month warranty. Visit the Jumia Flex website to learn more about purchasing a smartphone and paying in installments.

UPDATE: The Jumia Flex gadget financing program is currently not available. Whenever Jumia Nigeria brings the program back up, we’ll keep you posted.

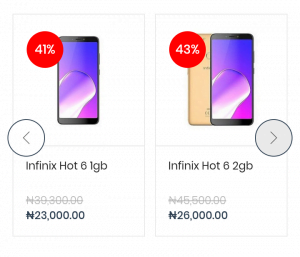

3. SLOT Nigeria

SLOT (www.slot.ng) is one of the oldest and biggest offline retailer of smartphone and all types of gadgets in Nigeria with over 60 stores spread across 18 states in the country. SLOT formerly sold phones, gadgets, accessories, and other home/office electronics to customers on a one-off payment model only but the company now offers more flexible gadgets acquisition plans.

Customers can trade in their old smartphones for a new one as well as purchase a news smartphone and pay in monthly installments over a specified period. Like Jumia, SLOT also offers 3 & 6 months repayment plans for smartphones, accessories, laptops, and other gadgets and electronics.

To purchase a phone from SLOT and pay later, you’ll have to visit any SLOT store/branch that closest to you to make enquiries regarding the device(s) you want to purchase, the price, payment plans, and any other details that you need to know. If the terms of the financing sit well with you, you’ll be asked to fill an application form and submit the necessary documents. Do that and your application will be processed in 24 hours.

If approved, the device you want to purchase will be handed to you and you can continue with the payment of the device later.

4. ParktelOnline

ParktelOnline (www.parktelonline.com) is another leading smartphone retailer in the country that also provides smartphone financing plans. ParktelOnline basically sells mobile devices and accessories only and as such wants to put smartphones in the hands of those who aren’t financially capable enough for a one-off payment.

ParktelOnline’s “Buy now, pay later” plan is only available for its customers located in Lagos and Abuja, and is available for products NGN 50,000 and above. Application can be done online via its website or at any ParktelOnline store in Lagos and Abuja.

Smartphone financing plans not only makes it easy to purchase devices without breaking the bank, it also ensures that you don’t miss out on the latest technology because you currently cannot afford it. These are currently the popular platforms that offer “Buy Now, Pay Later” financing plans in Nigeria. We’ll keep this list updated if more companies spring up.